2024 Cyber Resilience Research Unveils Financial Services Industry Challenges

New data illuminates how financial services leaders can prioritize resilience.

Financial services institutions find themselves at the intersection of progress and peril in the rapidly evolving digital landscape. The latest data underscores that the trade-offs are significant and pose substantial risks to financial institutions.

Get your complimentary copy of the report.

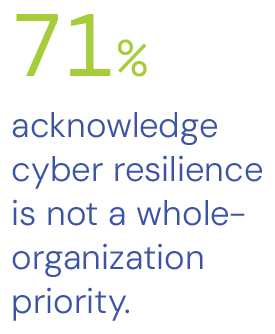

One of the foremost obstacles is the disconnect between senior executives and cybersecurity priorities. Despite recognizing cyber resilience as a crucial imperative, many financial services institutions struggle to secure the support and resources from top leadership. This lack of engagement hinders progress and leaves institutions vulnerable to potential breaches.

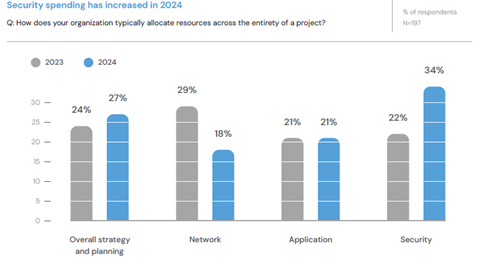

Meanwhile, technology continues to advance astonishingly, as do the risks posed by cyber threats. The 2024 LevelBlue Futures™ Report reveals this delicate balancing act between innovation and security within the financial services industry. Our comprehensive analysis identifies opportunities for deeper alignment between executive leadership and technical teams.

The Elusive Quest for Cyber Resilience in Financial Services

Imagine a world where financial services institutions are impervious to cyber threats—where every aspect of an operation is fortified against disruptions. This is the lofty ideal of cyber resilience, yet it remains an elusive goal for many financial services institutions. The rapid evolution of computing has transformed the IT landscape, blurring the lines between legacy systems, cloud computing, and digital transformation initiatives. While these advancements bring undeniable benefits, they also introduce unprecedented risks.

Our research indicates that 85% of finance respondents agree that dynamic computing increases their risk exposure. In a world where cybercriminals are becoming increasingly sophisticated, the need for cyber resilience has never been more urgent. From ransomware attacks to crippling DDoS incidents, financial institutions operate in a climate where a single breach can have catastrophic consequences.

Exploring the Relationship Between Leadership and Cyber Resilience

Our survey of 1,050 C-suite and senior executives, including 197 from the finance sector across 18 countries, highlights the pressing need for cyber resilience. The report is designed to foster thoughtful discussions about vulnerabilities and improvement opportunities.

In the report, you’ll:

- Discover why financial services leaders and tech teams must prioritize cyber resilience.

- Learn about the critical barriers to achieving cyber resilience.

- Uncover the importance of business context and operational issues in prioritizing resilience.

Recognizing the Imperative of Cyber Resilience

Financial services leaders are called to chart a course toward greater security and preparedness. Reacting to cyber threats as they arise is no longer enough; organizations must proactively bolster their defenses and cultivate a culture of resilience from within.

Our research delves into the multifaceted challenges facing financial services institutions in their quest for cyber resilience. From limited visibility into IT estates to the complexity of integrating new technologies with legacy systems, financial institutions grapple with deep-seated barriers that hinder their ability to withstand cyber threats.