With hardware sales slowing, Apple shifted to expanding its digital services offerings to generate billions each quarter. One service stands out as the clear leader.

Apple has been aggressively expanding its Services segment, including Apple Music, Apple TV+, AppleCare, and the App Store, to create a steady revenue stream that balances hardware sales. While all services are not equally popular, paid iCloud storage is the most widely adopted despite its low cost compared to other services.

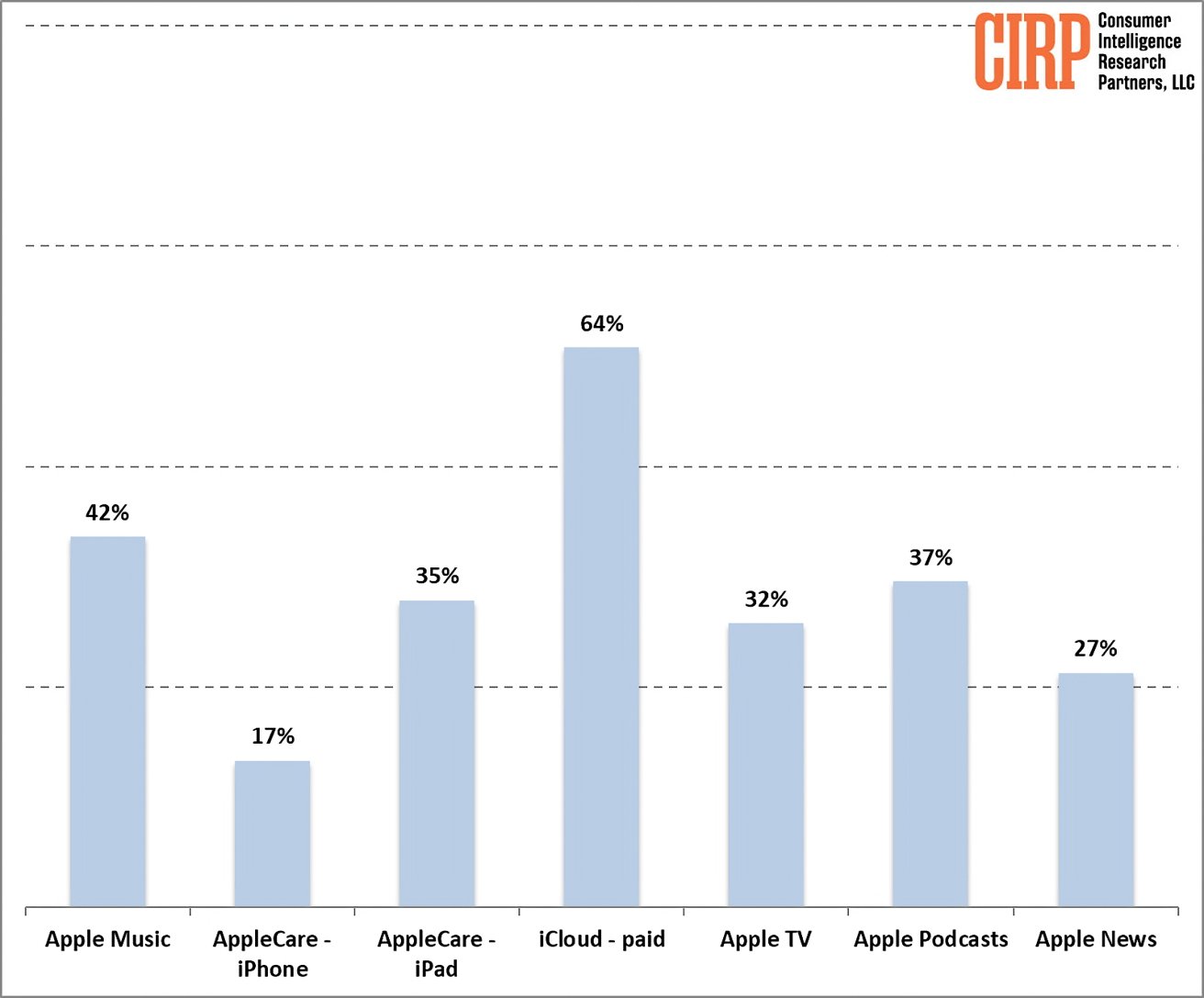

Nearly two-thirds of US Apple customers subscribe to paid iCloud storage, according to new data from Consumer Intelligence Research Partners (CIRP). The seamless integration across Apple devices and the paltry 5GB free storage limit encourage users to upgrade to paid tiers once they exceed it.

The deep integration of iCloud storage into Apple’s ecosystem and its lack of direct competition make it the default choice for most Apple users. As a user’s digital footprint grows, system prompts encourage users to upgrade their storage, ensuring a smooth transition from free to paid tiers.

Although competing cloud storage services like Microsoft’s OneDrive, Google Drive, and Dropbox exist, they lack the ability to seamlessly integrate into macOS or iOS. Consequently, users are required to manually upload their files, which may result in specific data types, such as Apple Notes, eBooks, and health data, getting left behind.

The competition: streaming services & AppleCare

Apple’s streaming services face tougher competition. Apple Music competes with Spotify, while Apple TV+ faces Netflix. However, Apple Music and Apple TV+ have significant market shares, with 42% and 32% of Apple customers subscribing, respectively.

The company’s other media services, like Podcasts and News, have a substantial user base, but these numbers may include free users. The fierce competition, with many alternatives, makes it harder for Apple to dominate these areas, unlike with iCloud storage.

AppleCare, the company’s extended warranty service, has lower adoption rates than its digital services. Due to competition from carriers and retailers, only 17% of iPhone buyers opt for AppleCare. Unlike iCloud storage, AppleCare faces direct competition in a market with multiple options at the point of sale.

Apple faces the dual challenge of maintaining existing service growth and innovating new offerings to capture customer interest. Paid iCloud storage’s success demonstrates how tightly integrated services drive user adoption and steady revenue.

However, replicating this success across services requires navigating a more complex competitive landscape. Apple’s ecosystem leverage is crucial for sustaining the growth of the services segment.